Industrial Outlook: Continued Strength in Planned Project Spending

Continued strength in North American industrial project activity in November lent support to a gradually strengthening U.S. economy.

#VMAnews

Each month, Industrial Info Resources measures the value of active North American capital and maintenance projects scheduled to start construction in the current year. Then, that figure is compared to the rate of scheduled annual spending for the prior year. A positive number signals growth, while a negative number signals a contraction in industrial spending.

Consistent with previous months, the U.S. regions reporting the strongest year-over-year gains in scheduled project spending remain the West Coast, Southwest, Rocky Mountains and Southeast regions. A surge in project spending took place in the Midwest and New England regions, while more modest gains were recorded in the Northeast, Mid-Atlantic and Great Lakes regions compared to 2010. Western Canada and Quebec continued to report sharp year-over-year gains in scheduled project spending. This year, project spending is scheduled to rise slightly in Atlantic Canada compared to last year, while Ontario expects to see a decline in project spending this year compared to 2010. Scheduled spending in Mexico increased slightly compared to year-earlier levels.

On a dollar basis through November, North American project spending growth this year has been strongest in these industries:

- Metals & Minerals, up $14.9 billion to $40.3 billion

- Power, up $11.8 billion to $82 billion

- Industrial Manufacturing, up $10.7 billion to $32 billion

- Oil & Gas Production, up $3.9 billion to $19 billion

On a percentage basis, North American project spending growth this year was strongest in these industries:

- Terminals, up 92%

- Metals & Minerals, up 59%

- Alternative Fuels, up 56%

- Industrial Manufacturing, up 51%

- Pulp, Paper & Wood, up 48%

The November data showed that none of the 12 North American industries tracked by Industrial Info are planning to reduce spending this year compared to 2010. Continued strong demand and high commodity prices are driving project spending plans in the Metals & Minerals and Oil & Gas Production industries, while increased consumer demand for consumer electronics and durable goods are propelling spending plans for companies in the Industrial Manufacturing industry. Spending in the Power industry continues to be driven by U.S. environmental regulation and the requirement that renewable energy projects receiving federal cash grants begin construction by year-end 2011.

For additional information, view the December 2011 issue of Industrial Info’s NAVIGATIIR online newsletter.

RELATED CONTENT

-

Check Valves: The Most Important Valves in Your Process System

Check valves, as critical as they are for flow system performance, often don’t receive the respect they are due, said Arie Bregman, vice president and general manager, DFT, Inc., in a recent VMA presentation.

-

Using Additive Manufacturing for Valve Repairs Across the Globe

Printing components on-site will allow for faster repairs and parts replacement for critical applications.

-

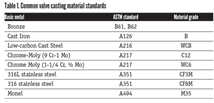

Free VMA Webinar: Valve Materials, Part 2

Tuesday, June 7, 2022 at 3 p.m. EDT.

Unloading large gate valve.jpg;maxWidth=214)